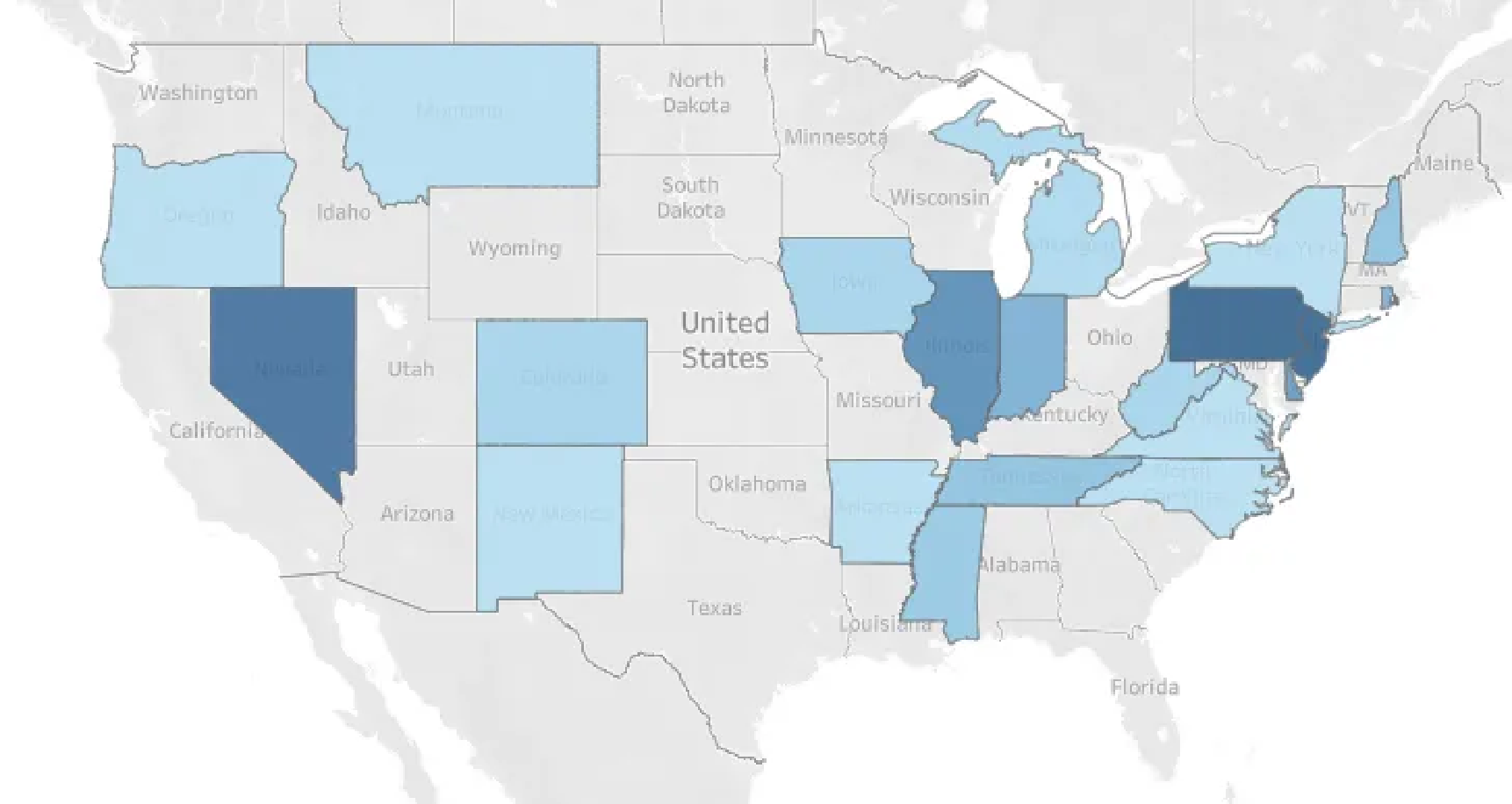

- Darker Blue = More State Tax Revenue

- Some states have been around longer than others

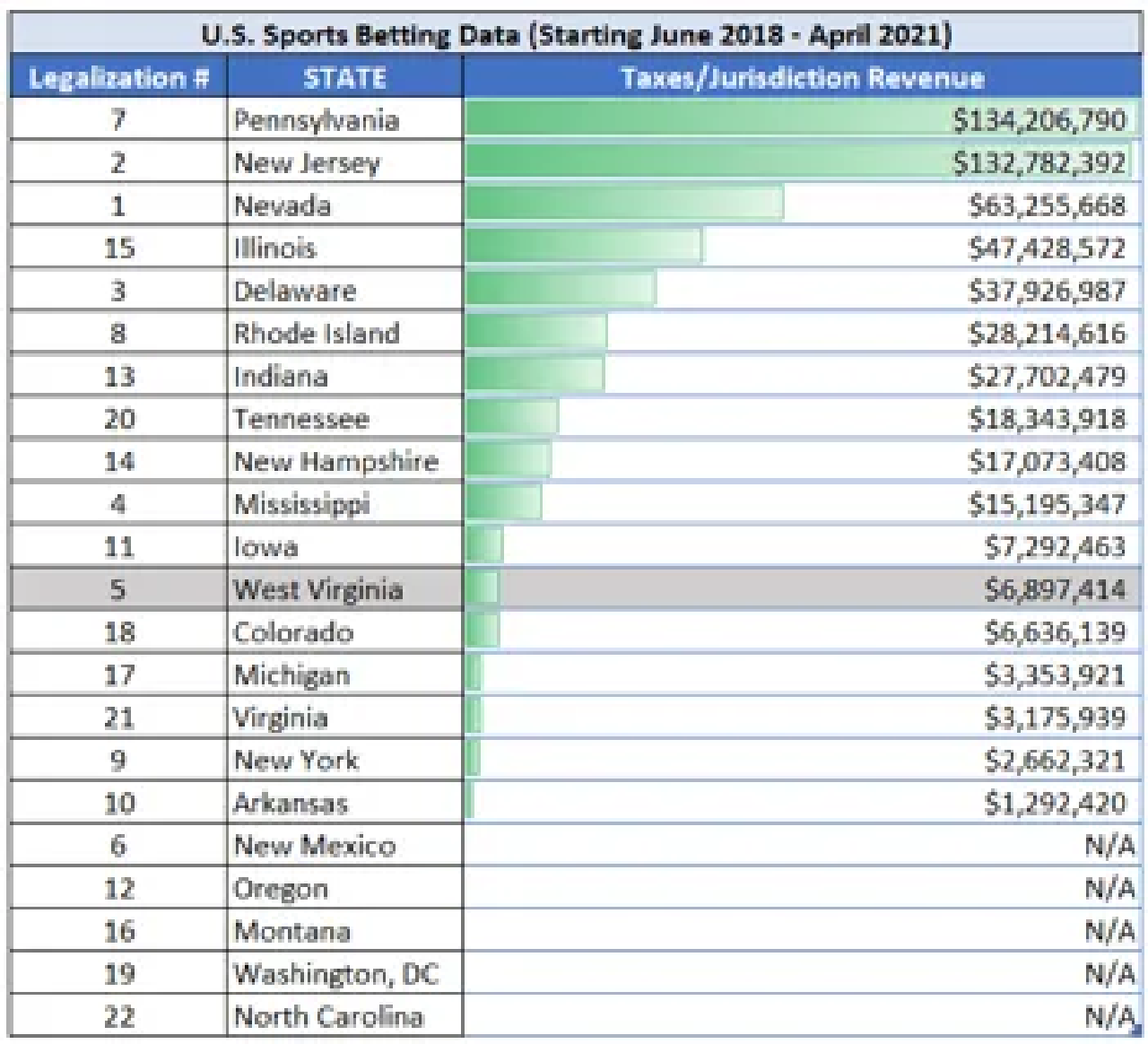

- See the following visual for total dollar amount of state tax revenue for each state

WV has completely lost our first mover advantage and needs to act fast before our state gets left behind, like usual. Population of individuals over the legal gambling age in these states does play a significant role in these numbers. However, WV has a major legislation issue that has hindered potential economic growth for our beloved state.

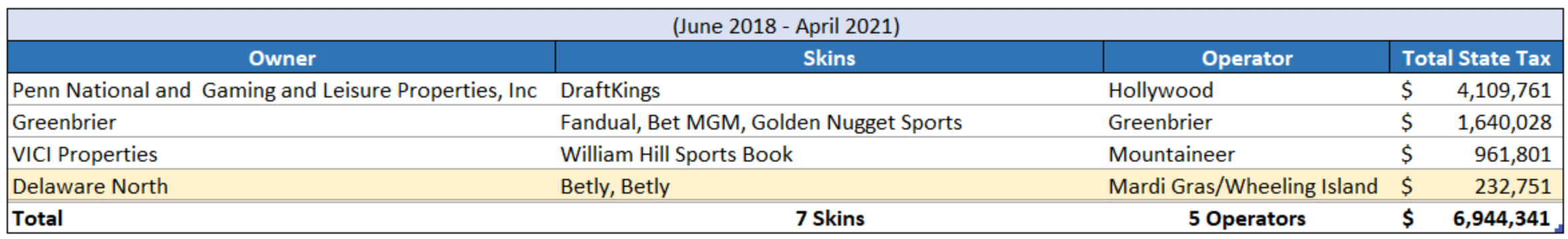

Below we will focus specifically on West Virginia data and how we think WV can recapture the millions of dollars in tax revenue lost.

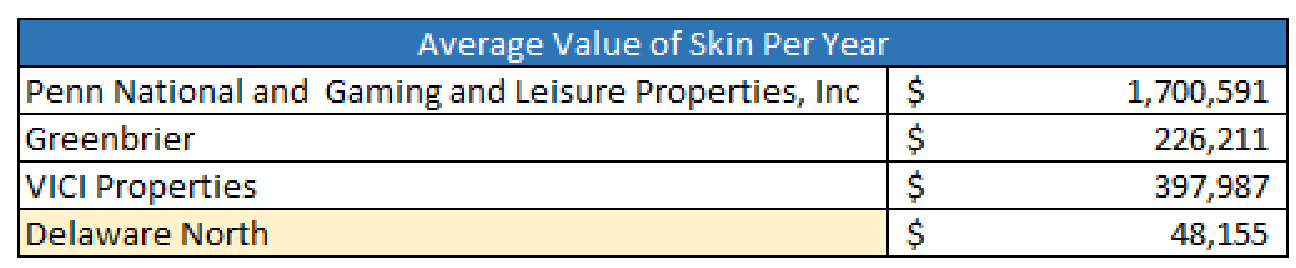

The chart above displays the per year value of skin tied to each owner. When compared to the state average of $410,502, we can see the value of missed opportunities from these owners.

**This missed opportunity is directly tied to the current teathered licensing structure in WV.**

Delaware North has 2 skins with Miomni that are inactive. Delaware North's average value of skin per year is already significantly behind the WV average. When we factor in their inactive licenses, they are costing WV hundreds of thousands of dollars.